Private credit is one of the largest — and least understood — markets in global finance.

It doesn’t trend on X.

It doesn’t move with Bitcoin.

And most people never get access to it at all.

Yet over the last decade, private credit has quietly grown from $300B to roughly $2.5T, delivering double-digit returns with low correlation to public markets.

So why hasn’t it mattered to crypto until now?

That’s the question at the heart of this conversation with Tomer Bariach, CEO of Textile, and Dr. Mark Richardson, Project Lead at Bancor, and the reason private credit is finally starting to move onchain.

What is private credit, really?

At its core, private credit is simple.

It’s lending money directly — outside of public bond markets.

No stock exchange.

No public prospectus.

No tradable bonds.

Instead, capital moves through private agreements between companies, lenders, and intermediaries.

In practice, this often looks like:

Fintech companies borrowing capital to fund loans they issue themselves

Businesses financing invoices, inventory, or trade flows

Credit arrangements structured around real cash flows, not speculation

It’s closer to “friends lending to friends” than Wall Street trading desks — but at a global, institutional scale.

And critically:

Most of the Global South doesn’t run on public markets — it runs on private credit, where access is often relationship-driven and opaque. High-growth fintechs with real traction can stay invisible to global private credit allocators simply because they aren’t in the right networks.

The capital that fuels supply chains, payrolls, and trade often never touches a public exchange.

Which leads to the real problem.

Why private credit stays exclusive

Private credit works — but it’s inefficient and closed.

If you want exposure today, you don’t buy an index.

You analyze every single deal:

Who is the borrower?

What’s the collateral?

What’s the risk?

What happens if things go wrong?

That’s the opposite of how modern investing scales.

Compare it to the S&P 500

You don’t evaluate 500 companies individually.

You trust the structure.

Private credit has never had that structure.

And there’s one main reason why.

Why private credit never came onchain

Private credit didn’t stay offchain because of regulation alone.

It stayed offchain because existing onchain markets were the wrong shape.

DeFi liquidity was designed around assets that:

Trade constantly

Have thousands of participants

Require continuous two-sided markets

Private credit has none of those properties.

Credit positions are:

Sparse

Time-bound

Intentionally held

Bought with the expectation of finality

Traditional AMMs assume perpetual re-trading.

Private credit requires trades to settle once.

Until that mismatch was resolved, bringing private credit onchain wasn’t just difficult — it was structurally impossible.

The liquidity problem

Private credit is illiquid by design.

Once capital is deployed, it’s locked until maturity.

If you want out early, you usually have one option:

ask the borrower to repay you.

That makes:

Portfolio rebalancing nearly impossible

Index-like products unworkable

Passive exposure unrealistic

Liquidity here isn’t a “nice to have.”

Without it, structured products simply can’t exist.

And this is where blockchain — and Carbon DeFi — change the equation.

What changes when private credit goes onchain

Tokenizing private credit is about unlocking secondary markets without breaking the primary agreement.

Onchain, a credit position becomes:

A programmable asset

Transferable without renegotiating the loan

Priced by market participants, not gatekeepers

That means:

Positions can be sold before maturity

Duration risk can be priced dynamically

Liquidity can emerge organically

Not constant, forced liquidity — but intentional liquidity.

This distinction matters.

Why Carbon DeFi makes this possible

Private credit exposed a blind spot in DeFi liquidity design.

Traditional AMMs assume something that private credit doesn’t have:

continuous two-sided markets.

Private credit positions are:

Sparse

Asynchronous

Held intentionally

Carbon DeFi was built for exactly this type of market.

On Carbon DeFi, participants define:

When they’re willing to buy

When they’re willing to sell

At what price

And only at those prices

There’s no obligation to quote both sides.

No automatic re-selling.

No forced exposure.

A trade settles once — cleanly.

That’s crucial for credit markets, where buyers don’t want their position immediately traded back against them.

This model enables:

Secondary liquidity without constant churn

Price discovery without volume games

Exit options without breaking loan terms

Carbon DeFi provides the market structure private credit has always needed — but never had.

Textile’s role: opening the system

Textile isn’t a lender.

It’s a private credit network — a factory for creating onchain credit markets.

Anyone can:

Open a credit pool

Define the terms

Tokenize credit exposure

But Textile doesn’t rely on blind trust.

Instead, it introduces underwriters.

Underwriters: measured, priced, and rewarded.

In Textile, underwriters matter more than borrowers.

They:

Bring real-world deals onto the network

Perform due diligence

Stake capital as first-loss risk

Earn more when deals perform well

Their rewards scale with:

Active credit volume

Repayment performance

Longevity

Capital at risk

Good underwriting earns more.

Bad underwriting earns less — or loses capital.

What kinds of markets are emerging?

Textile doesn’t dictate which credit markets win.

Underwriters do.

That’s why early markets include:

Crypto-backed lending

Trade finance

On/off-ramp liquidity

Invoice-backed credit

Working capital for fintechs

Some are global.

Some are local.

Some are denominated in USD stablecoins.

Others in local currencies — often with higher yields due to misunderstood FX risk.

The market decides.

Why this matters

Private credit already runs a large part of the global economy.

What it’s lacked is:

Transparency

Liquidity

Accessibility

Programmability

Blockchain provides the rails.

Textile provides the credit layer.

Carbon DeFi provides the necessary liquidity infrastructure.

Together, they turn private credit from a closed “friend circle” into an open system.

Bancor

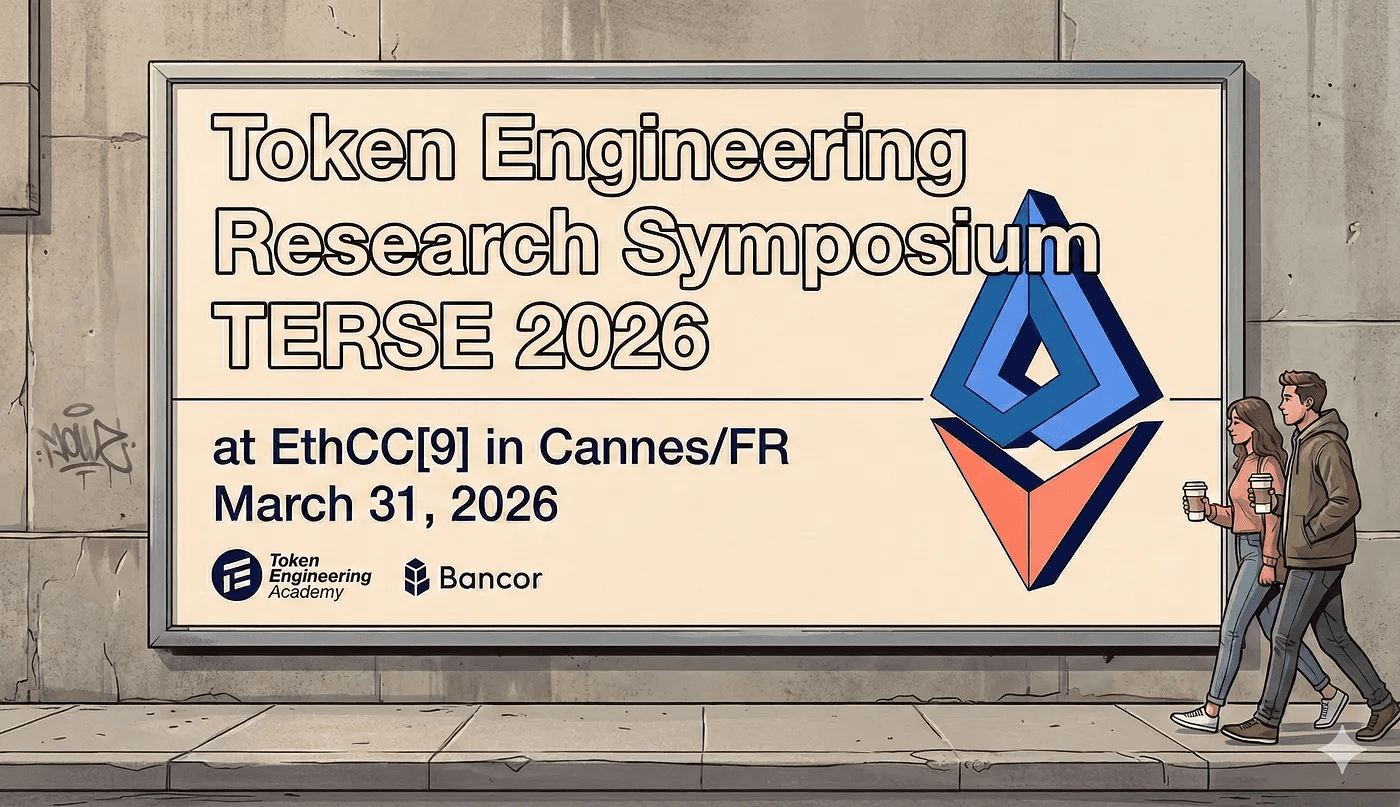

Bancor is a pioneer in decentralized finance (DeFi), established in 2016. It invented the core technologies underpinning the majority of today’s automated market makers (AMMs) and continues to develop the foundational infrastructure critical to DeFi’s success — focusing on enhanced liquidity mechanics and robust onchain market operation. All products of Bancor are governed by the Bancor DAO.

Website | Blog | X/Twitter | Analytics | YouTube | Governance

Carbon DeFi

Carbon DeFi, Bancor’s flagship DEX, enables users to do everything possible on a traditional AMM — and more. This includes custom onchain limit and range orders, with the ability to combine orders into automated buy low, sell high strategies. It is powered by Bancor’s latest patented technologies: Asymmetric Liquidity and Adjustable Bonding Curves.

Website | X/Twitter | Analytics | Telegram

The Arb Fast Lane

DeFi’s most advanced arbitrage infrastructure powered by Marginal Price Optimization, a new method of optimal routing with unmatched computational efficiency.

Website | Research | Analytics