In this update we’ll cover:

Carbon Beta Stats

Trading Competition + Top APRs

Integrations

Governance

Community & Content

Carbon Beta Network Stats

Carbon has seen a significant increase in user activity in recent weeks, with a large rise in strategies and trades executed via the carbondefi.xyz app, trade aggregators and directly onchain.

As of this writing, the Carbon beta has seen over $1.15M in liquidity deployed across 200 strategies, and over $500K in total volume. That’s a 267.41% increase in liquidity and 405.15% increase in volume in the past month.

📊 Track Carbon network stats on analytics.carbondefi.xyz or on this brand new Dune dashboard.

Protocol Arbitrage

The Carbon arbitrage framework, powered by Fast Lane, continues to earn fees for the protocol while enabling efficient strategy execution. The Fast Lane recorded its largest daily protocol earnings to date on June 14th (2,658 BNT). Recent gas optimizations are expected to further improve arb efficiency.

🤖 Learn how to run your own arbitrage bot using Fast Lane, or get support in the Carbon Telegram channel.

Carbon’s ROI Trading Competition

Carbon’s ROI trading competition is live! Unleash your trading skills and compete with fellow community members to achieve the highest ROI. Win USDC for top-ranking strategies and swag along the way. The competition lasts until July 11, 2023, and existing strategies deployed before the competition’s start date also qualify —just claim the competition NFT on Galxe.

💰 More details: carbondefi.xyz/tradecarbon

One week into the competition, leading wallets are already posting double-digit APRs 👀

Breakdown of the top 3 leading strategies:

Trader 0x6E..531

Pair: ETH/USDC

Strategy type: recurring, 2 ranges

ROI: 1.52% (78.81% APR)

Sell ETH range: 1975–2300 USDC

Buy ETH range: 1600–1850 USDC

Funding:

Start: 0.55529 ETH, 1008.37 USDC

Current: 0.99385 ETH, 272.56

2. Trader 0xBa..b67

Pair: WBTC/USDC

Strategy type: recurring, 2 ranges

ROI: 1.08% (55.75% APR)

Sell WBTC range: 27,187–31,000 USDC

Buy WBTC range: 19,750–25,603 USDC

Funding:

Start: 0 WBTC, 21,010 USDC

Current: 0.09713 WTBC, 18558.58 USDC

3. Trader 0x36..6f6

Pair: ETH/USDC

Strategy type: recurring, 2 limits

ROI: 0.95% (49.20% APR)

Sell ETH limit: 2090 USDC

Buy ETH limit: 1710 USDC

Funding:

Start: 2.8 ETH, 4997 USDC

Current: 5.72254 ETH, 0 USDC

🏆 Think you’ve got what it takes? Enter to win today.

🎉 More ways to win: Incentivized Dappback tasks are also live, with USDC prizes up for grabs!

Integrations

InsurAce

You can now insure your Carbon strategies using InsurAce, one of the industry’s leading decentralized insurance protocols! As of this writing, there’s nearly $200K in capacity and rising!

🛡Get protected: https://app.insurace.io/coverage/buycovers

DeBank

A proposal to integrate Carbon is live on DeBank, a leading portfolio analyzer. Over $10m in total voter value has voted in support of the integration.

🗳 Support the initiative, and upvote the proposal: https://debank.com/proposal/5411

DEX Aggregators

Aside from Carbon’s existing integration with OpenOcean, a number of integrations with leading DEX aggregators are in the works and expected soon, so stay tuned!

Governance

There is a proposal in Bancor governance to create a protocol-owned strategy on Carbon valued at roughly $4–5 million using protocol-owned liquidity. The BancorDAO is currently discussing how to create the strategy and which token pair to create the strategy with. DAO participants have proposed using a stablecoin/stablecoin recurring strategy (e.g., USDC/USDT) or an ETH-LST/ETH-LST recurring strategy (e.g., rETH/wstETH) due to these token pairs trading in relatively predictable ranges and requiring minimal maintenance by the DAO.

🏛 See the proposal here: https://gov.bancor.network/t/consolidating-recent-proposals-by-alphavalion/4330

Community & Content

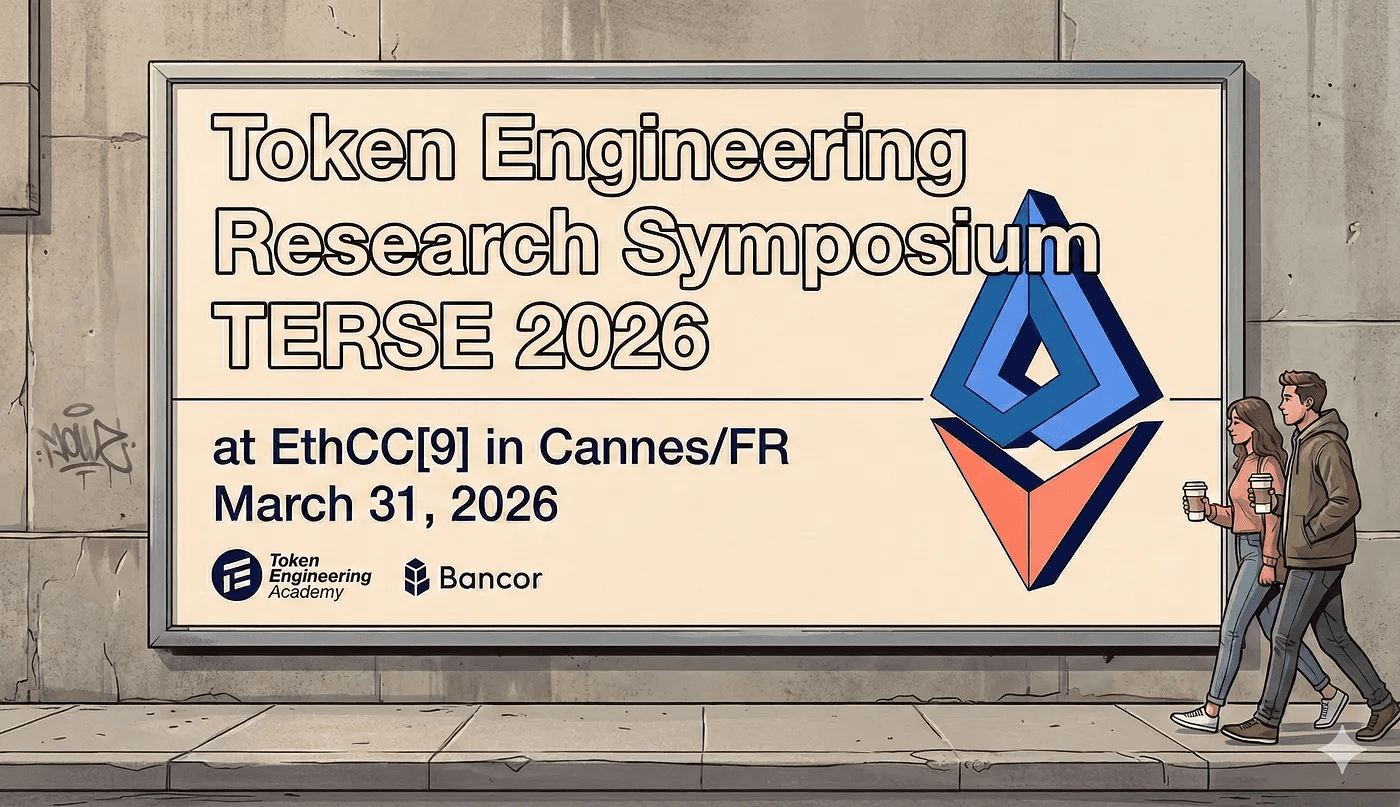

EthCC

Attending EthCC next month in Paris? Join us for a day dedicated to Token Engineering! Dr. Mark Richardson will present “Carbon — a Significant Change for Onchain Liquidity, and How We Designed it” on July 19th. More details

Carbon x Empire Podcast

Radix Podcast

Zeno: Backtesting Carbon Strategies

Spaces & Podcasts

Upcoming Thursday June 22: The power of DEX aggregators with OpenOcean

Upcoming Friday June 23: Comparing Uni v4 to existing trading protocols

What’s needed for DeFi to succeed Qredo and Liquity

Accessible DeFi with Mellow and Swell Labs

“Loss vs. rebalancing” in AMMs with DeFi Cheetah

Decentralized options and order books with Aori and Foxify