In this update we’ll cover:

Top Performing Strategies

Dev Update

Governance

Community & Content

Top Performing Strategies

The number of user strategies created onchain and via carbondefi.xyz is growing — with over 230 strategies currently live.

The Carbon Dune Dashboard shows the top performing strategies in terms of ROI and APR:

In addition, market volatility combined with rising Carbon liquidity is creating more opportunities for the Fast Lane arbitrage bot to trade against live strategies. By closing arb opportunities between Carbon and external exchanges, Fast Lane drives revenue to the protocol. Fast Lane earnings have seen a notable increase in recent weeks, recording all-time daily highs earlier this week:

Dev Update: Carbon Portfolio

The new Carbon Portfolio is live!

With the Carbon Portfolio, you can now:

See the total value of your trading strategies

Get a breakdown of each strategy

Explore live strategies by token

More features are coming to the Portfolio including ROI and earnings stats, so stay tuned!

To access your Portfolio, login to app.carbondefi.xyz and click “Portfolio” in the upper left hand side of the screen.

Governance

1. Custom taker fee on stable to stable trading

The Bancor DAO recently approved a proposal that will identify stablecoin pairs on Carbon that should have a custom fee that overrides the default network wide 0.20% trading fee. The goal of this proposal is to bring Carbon in line with other DEXs that charge a lower fee on stablecoin pairs.

Per the proposal, the following list of stablecoin pairs will be updated to have a 0.001% trading fee:

USDC/USDT

USDC/DAI

USDC/FRAX

USDC/LUSD

USDT/DAI

2. Selling protocol surpluses for ETH

The DAO approved a proposal to sell token surpluses in Bancor v3 for ETH. Following the conversion of surpluses the DAO will continue exploring potential usage of the ETH, with the overarching goal being to eliminate any remaining deficits in Bancor v2.1 and v3.

Community & Content

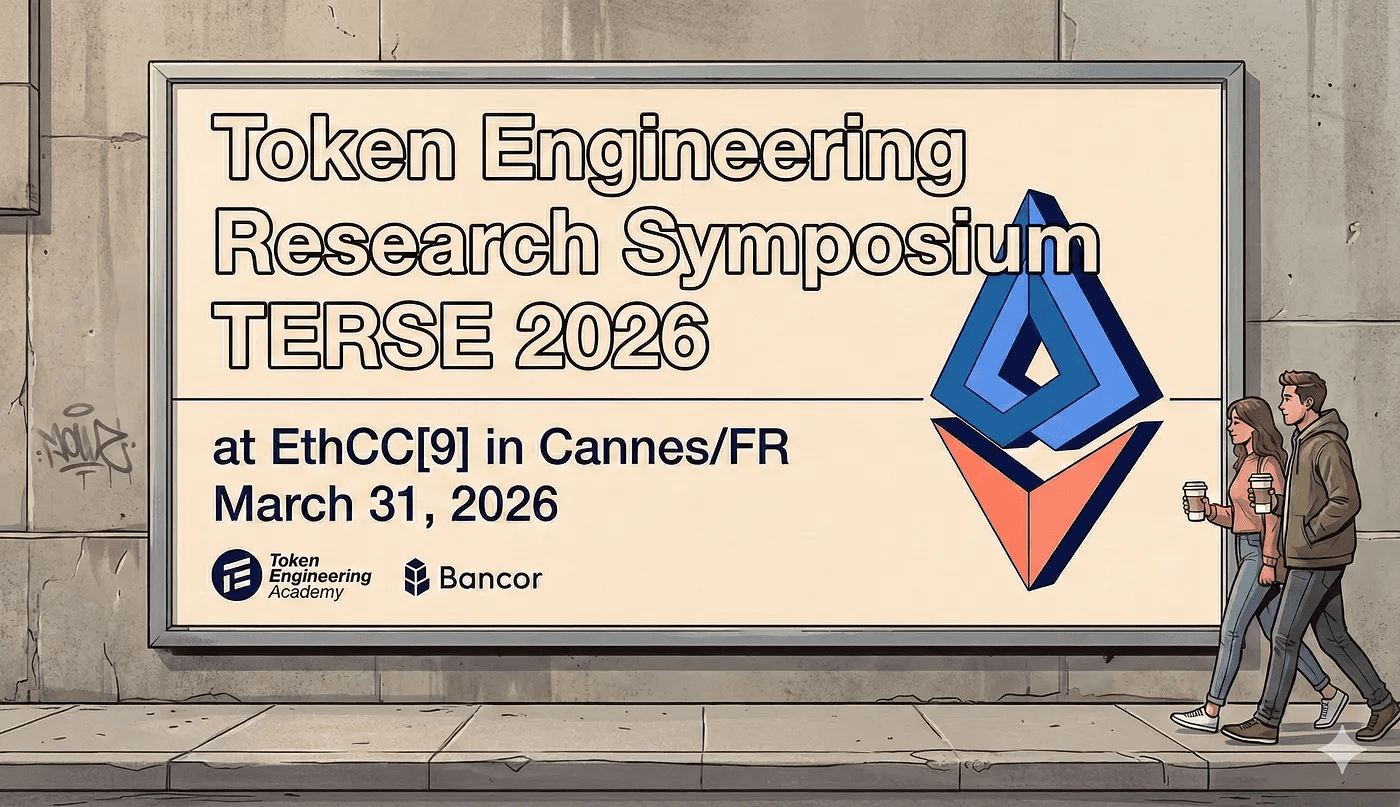

EthCC

A number of contributors attended EthCC in Paris to meet with different DeFi communities. Watch Dr. Mark Richardson’s presentation on Carbon:

Coinsider Covers Carbon!

Coinsider gives a walkthrough of how to use Carbon and his recent ETH/USDCstrategy that generated some juicy returns:

Zeno explores Linked Range Orders

Check out the Twitter thread with highlights.

Empire’s Carbon Strategy of the Week