Exploring this transformative shift towards automation in trading, let’s have a look at Carbon DeFi: a DEX at the crossroads of being a sophisticated trading protocol and a trading bot, particularly with the power of its integration with the Arb Fast Lane Protocol.

Automating Trading Strategies with Carbon DeFi

Carbon DeFi presents a unique blend of novel orderbook-style features, enabling users to customize trading strategies with the use of limit, range, and recurring orders. The recurring orders, reminiscent of grid trading bots, automatically rotate funds between a linked buy and sell order, thus sustaining an ongoing trading process without the need for constant user input. These advanced features, particularly the recurring orders, not only empower users with exceptional control, but due to its automatic and cyclical nature, also provokes thought regarding Carbon DeFi’s bot-like characteristics, perhaps bringing new ambiguity to the distinction between the two.

Order Execution in Carbon DeFi

A “strategy” on Carbon DeFi is a set of instructions that represent the specific prices at which its owner has elected to trade with the rest of the market. Since the owner is actively pricing their tokens, they are “making” the market; those who accept those prices and perform a trade are “taking” the market. Market takers may consist of individuals interacting directly through the UI or the smart contracts, or via a market aggregator such as 1inch and OpenOcean.

Specialists who interact with markets for the exclusive purpose of purchasing an asset and selling it atomically for a profit are called “arbitrageurs”, which are typically represented by automated infrastructure under their control, as opposed to an individual manually signing transactions. However, the motivations of a taker is unimportant from the maker’s perspective — if traders or their infrastructure is demonstrating an appetite to take the market at a given price, makers generally only care that those who are suitably motivated have access to the market they have created for them.

Arb Fast Lane: A Built-In Bot Feature?

Together Carbon DeFi and the Arb Fast Lane Protocol underscore an innovative, hybrid approach to on-chain market making systems, from which emerges something that truly resembles a traditional “trading bot”, save for the implementation details.

The strategic design of the Arb Fast Lane not only helps ensure efficient order execution but merges advanced technology with user-friendly functionality. This makes Carbon DeFi a unique and powerful tool in the DeFi space, combining custom trading strategy support with novel order types, efficient execution, and automated market arbitrage. It will forever remain the subject of debate as to whether Carbon DeFi is itself a bot, or has a “built-in bot”, or is “one-half of a trading bot”, or if the difference is semantic or significant.

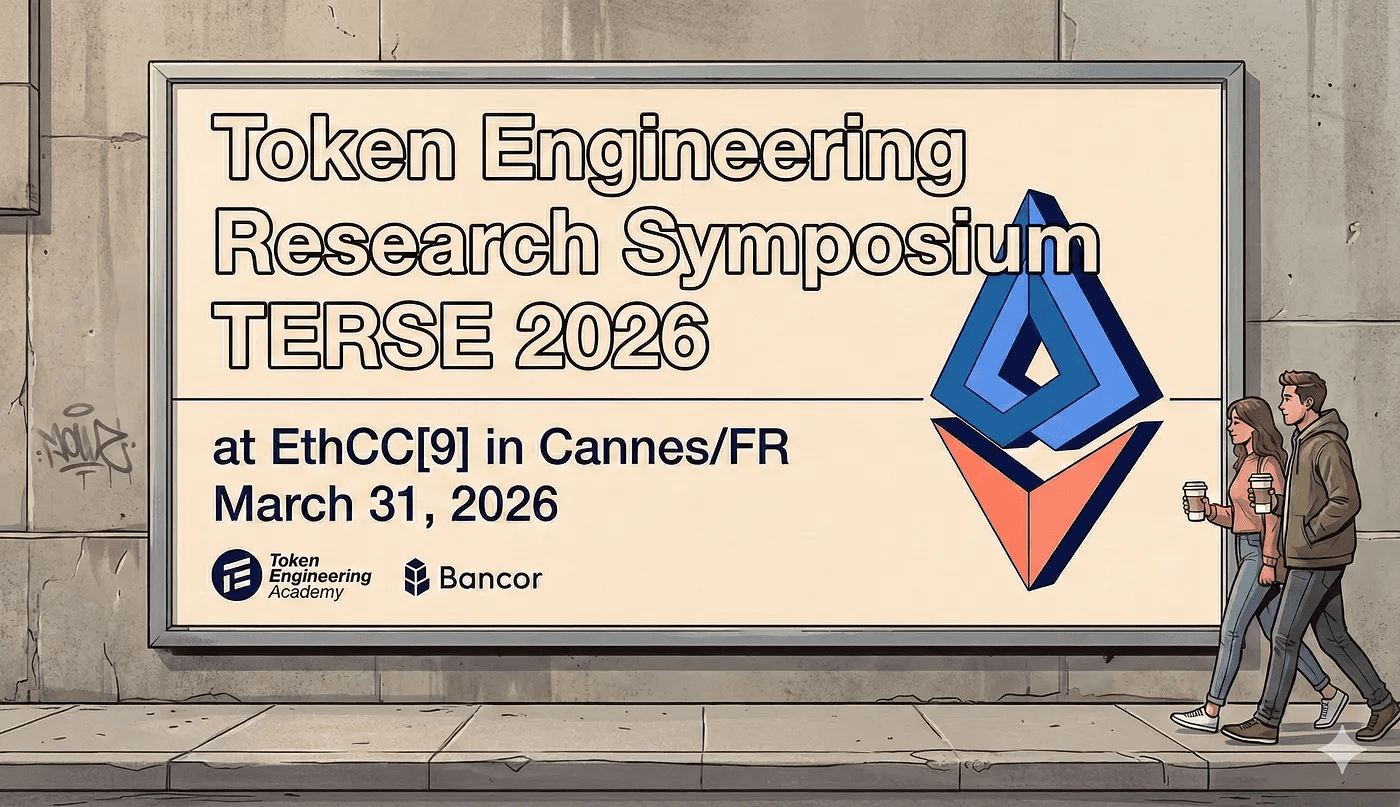

It also doesn’t matter; however you decide to categorize it, Carbon DeFi and the Arb Fast Lane are useful to players on both sides of the market, and stand as a testament to the innovative spirit of Bancor and decentralized finance.

Experience firsthand the impact of Carbon DeFi and discover how its automated orders and bot-like functionalities can transform your approach to decentralized trading.

Expanding Beyond Ethereum

As the debate continues over Carbon DeFi’s identity — whether it’s a sophisticated trading protocol or akin to a trading bot — Bancor’s latest strategy brings another noteworthy development to the forefront. While Carbon DeFi currently operates on Ethereum, Sei, Celo, COTI, and TAC, it’s set for expansion through third-party deployments enabled by Bancor licensing its smart contract technology. Alongside these third-party deployments, Bancor will launch the Arb Fast Lane Protocol, further extending Carbon DeFi’s unique capabilities and influence in the DeFi space.